You know that price isn’t everything.

There’s never been a consistent way to quantify consumer value until the Vive Score.

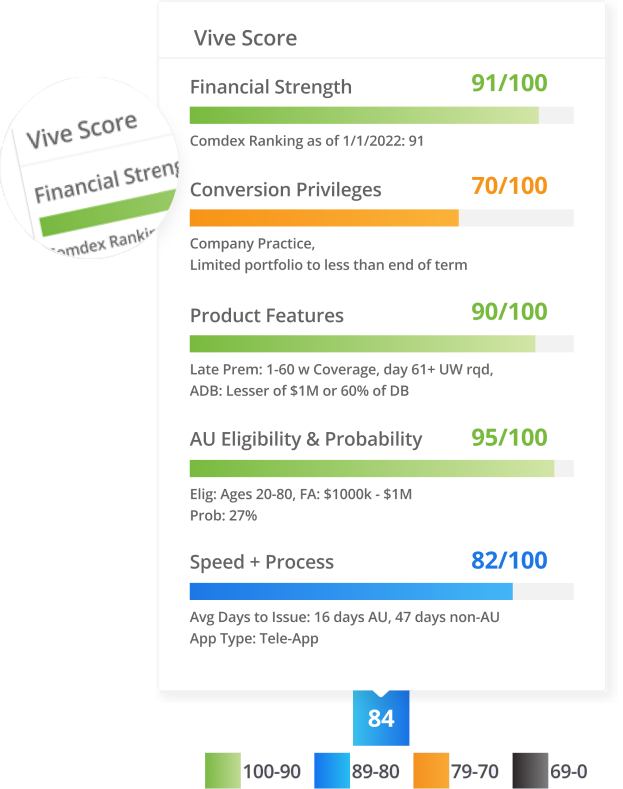

The Vive Score weights important factors beyond price.

The Vive algorithm considers the following weighted factors:

- Financial Strength – as defined by the Comdex Index

- Conversion Privileges – based on products eligible for conversion and length of conversion period

- Product Features – ranks premium grace periods and accelerated death benefit offerings

- AU Eligibility & Probability – considers if the proposed insured is eligible for Accelerated Underwriting (AU) and the probability AU will be offered

- Speed & Process – measures speed of policy from submission to issue (average number of days from prior three months) and if e-app/e-interview is offered

Vive aggregates all of these factors to display an overall Vive Score for the product.

Simply hover over the Vive Score on the quote screen to see more details.

You gain an instant level of product expertise.

The Vive Score is at its most valuable when you discuss options with your client before completing the order. It can provide you a sound, product-specific rationale for a recommendation that may not be the least expensive option.